How do I enter bank entries? (2024.05)

Reconciliation

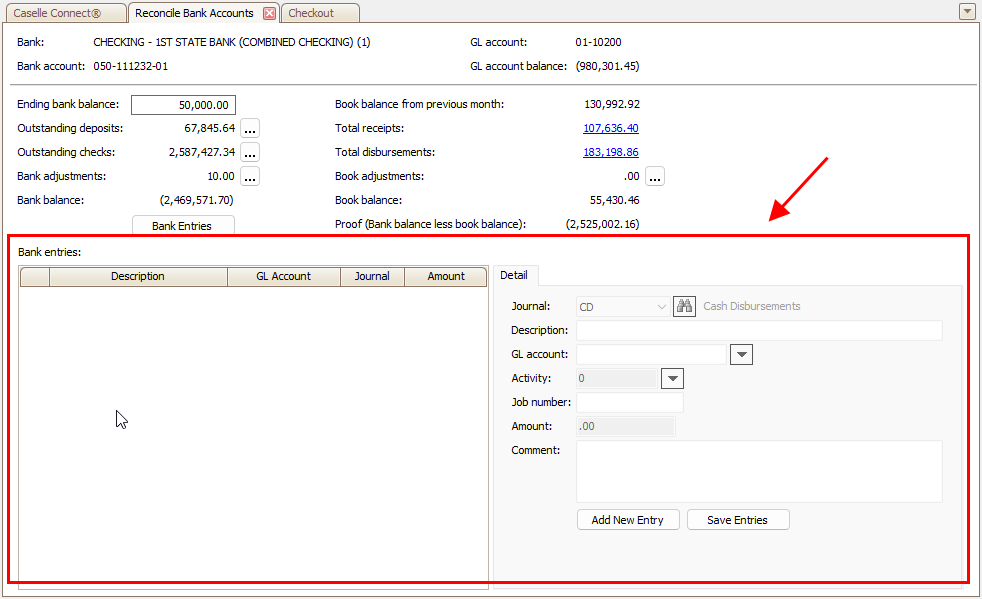

Create transactions from the Reconcile Bank Accounts view to record bank entries. A bank adjustment correct discrepancies between the organization's records and the bank statement. These adjustments ensure the organization's cash balance is accurately reflected in the general ledger after bank fees, interest, errors, or other differences.

For example, you may need to create a bank entry to enter an

-

NSF check,

-

interest earned on a bank account, or

-

bank fees.

Using Reconcile Bank Accounts to enter these kinds of transactions is helpful because you don't have to exit the Reconcile Bank Accounts view; enter a journal entry for the NSF check, interest earned, bank fee, and so on; and then return to the Reconcile Bank Account view to finish reconciling. [More]

The process for entering bank entries was updated in the 2024.05 release.

Watch a video

Learn how to use enter bank entries from the Reconcile Bank Accounts view.

Entering a bank entry

1. Open Connect General Ledger > Reconciliation > Reconcile Bank Accounts.

2. Click  .

.

The Bank Entries section displays at the bottom of the view.

3. Click  .

.

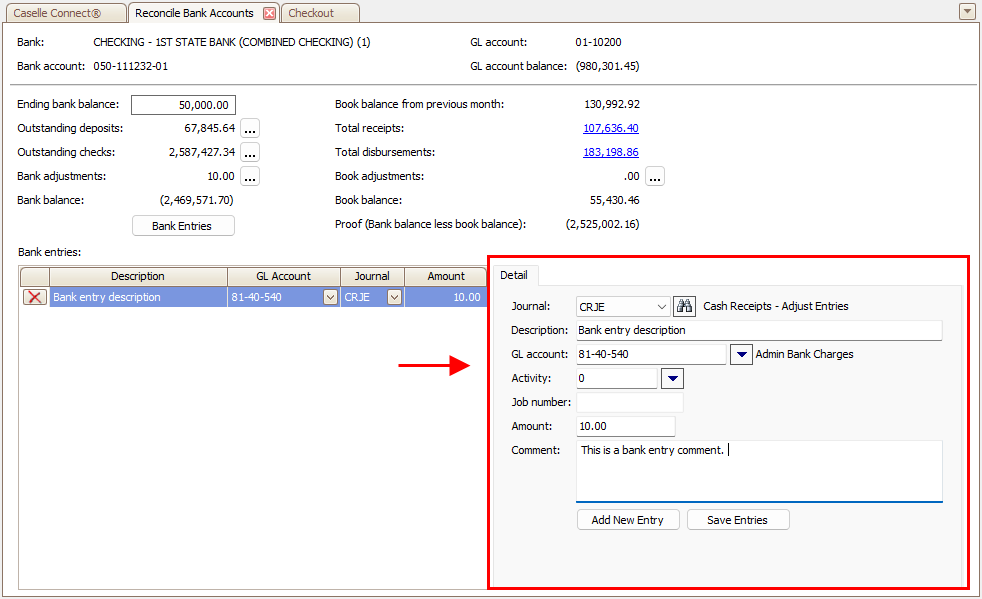

4. Use the pane on the right to enter the bank entry.

4. Click  .

.

5. Click Yes to create the offset transaction or you can use this entry form to enter the offset transaction on your own.

Saving the entry will create the bank fee, load the bank entry into the check or deposit section, and clears the bank entry so you don't have to clear it again.

Related topics:

How do I enter a bank adjustment? (2024.05)

How do I enter a book adjustment? (2024.05)

202405, 2023Dec07

Copyright © 2025 Caselle, Incorporated. All rights reserved.