How do I enter a bank adjustment? (2024.05)

Reconciliation

A bank adjustment correct discrepancies between the organization's records and the bank statement. These adjustments ensure the organization's cash balance is accurately reflected in the general ledger after bank fees, interest, errors, or other differences. Here are some common reasons for bank adjustments:

-

Bank fees. Banks may charge fees for various services, such as maintenance, wire transfers, or overdrafts. These fees my not have been recorded in the organization's books until the bank statement is received. A bank adjustment is made to account for these fees.

-

Interest earned. An organization may earn interest on its bank account, which may not be recorded until the bank statement arrives. A bank adjustment is made to add the earned interest to the organization's books.

-

Bank errors. Banks may make errors, such as posting the wrong amount for a transaction. Bank adjustments are needed to correct the organization's record to account the bank's corrections.

-

Returned checks (NSF checks). If a customer's check bounces due to insufficient funds (NSF), and adjustment is made to remove the originally recorded deposit from the organization's books.

Caution! Use bank adjustments sparingly. A bank adjustment records an entry to correct an error on the bank statement. Before you use a bank adjustment, you will need to contact the bank to confirm the error.

Example

For example, the bank clears a check for a different amount then the check amount that's recorded in Connect. Joe from City XYZ finds the error and calls the bank. The bank tells Joe that they will correct the check amount and the corrected check amount will show up on the next bank statement.

Now, Joe has two options: He can

(1) enter a journal entry in the current month and then clear it in bank reconciliation, and then enter a reversing journal entry in the following month and then clear it in bank reconciliation, or

(2) enter a bank adjustment and record it as a bank error.

Joe chooses to enter a bank adjustment. When Joe receives the bank statement for the next month, he will see a credit for the check amount. Joe marks the credit as cleared because it was entered as a bank adjustment in the previous month.

This view was updated in the 2024.05 release. The Bank Adjustment Entry section will be displayed at the bottom of the Reconcile Bank Accounts view instead of launching in a separate window. And there's a Delete button next to each entry to make it easier to delete a bank adjustment without the possibility of deleting the entire reconciliation by mistake.

Watch a video

Learn about the differences between bank adjustments and book adjustments.

Entering a bank adjustment

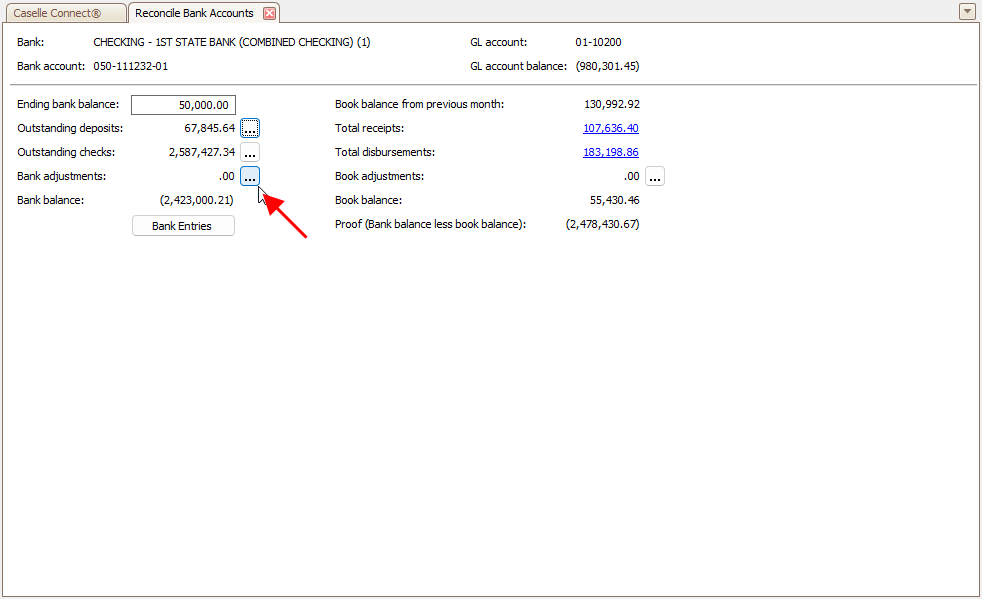

1. Open Connect General Ledger > Reconciliation > Reconcile Bank Accounts.

2. Click ![]() at the end of Bank Adjustments.

at the end of Bank Adjustments.

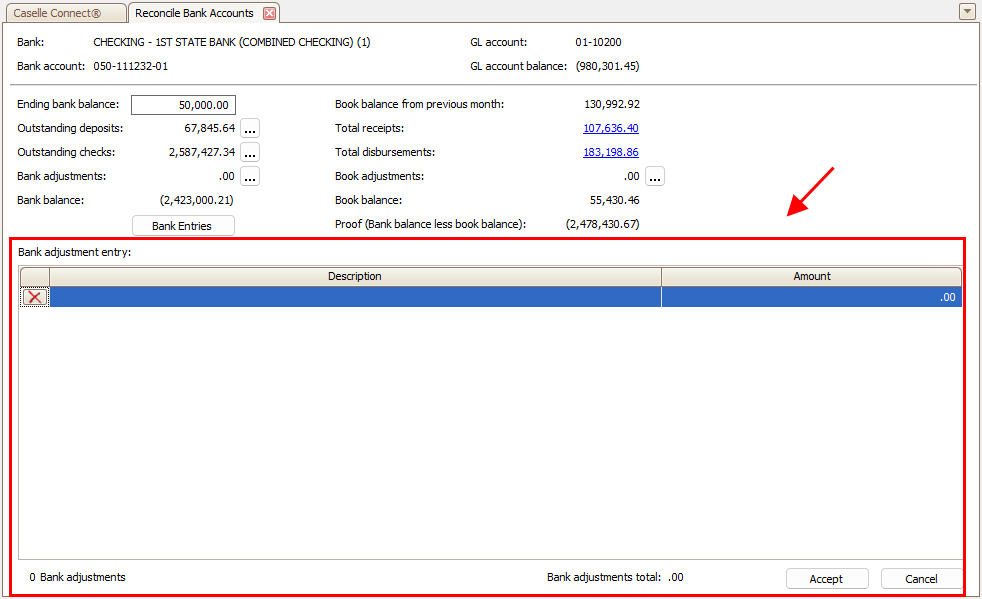

You can see the Bank Adjustment Entry section at the bottom of the tab.

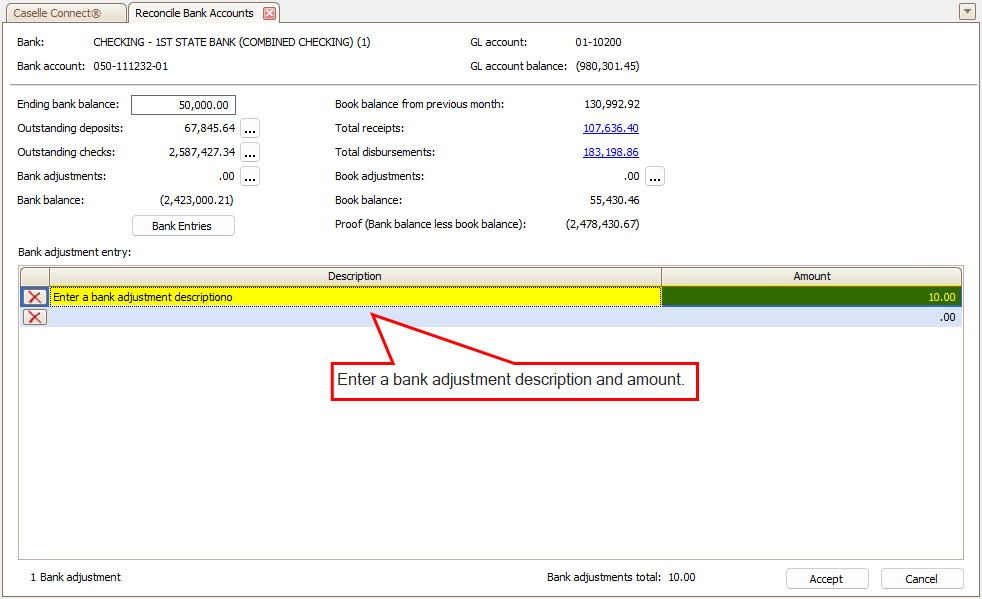

3. Click on a row and begin typing to add a bank adjustment description and amount.

4. Click  .

.

The bank adjustment is saved.

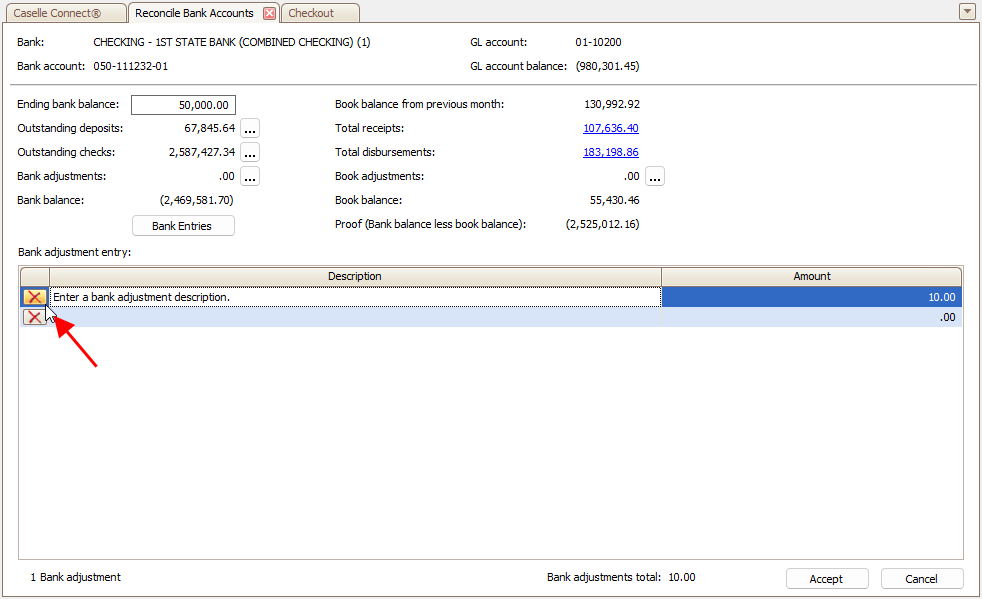

Deleting a bank adjustment

1. Open Connect General Ledger > Reconciliation > Reconcile Bank Accounts.

2. Click ![]() at the end of Bank Adjustments.

at the end of Bank Adjustments.

3. Click  at the beginning of the row.

at the beginning of the row.

Make sure you use the Delete button at the beginning of the row instead of using the Delete button in the main toolbar at the top of the view. The Delete button in the main toolbar will delete the reconciliation.

202405, 2023Dec07

Copyright © 2025 Caselle, Incorporated. All rights reserved.