A transmittal includes transmittal invoices and transmittal checks. You can set up Payroll to create transmittal invoices or print transmittal checks for you.

A Transmittal Check is a check that is issued to a vendor who has amounts which originated in Payroll, for example, health insurance. Use Payroll to print transmittal checks directly from the Payroll application. Once done, the checks are ready to send to the appropriate vendors.

A Transmittal Invoice is an invoice that is created in Payroll for Accounts Payable, which permits you to use Accounts Payable to issue the actual check. This option is available if the interface to Accounts Payable is enabled. Your accounts payable clerk would then take responsibility for paying the vendor.

In this Topic Hide

When do I set up transmittals?

Why do I want to use transmittals?

Step 2: Turn on the Accounts Payable interface

Step 3: Add the GL information

Change properties on an existing transmittal

Address and contact information

Pay codes used for transmittal calculations

How do I void and correct a transmittal check from a closed period?

Why are my transmittal transactions not posting to the general ledger?

How do I void and re-issue a lost transmittal check?

How do I fix double-postings to payroll journals?

How do I exclude an employee from my transmittal report when no premium is due?

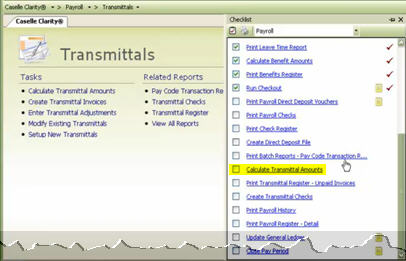

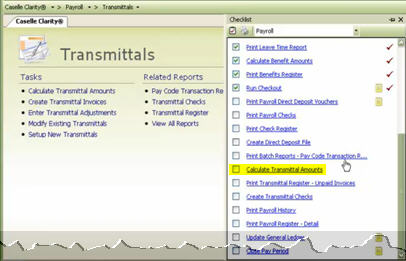

After you calculated payroll, printed payroll checks, run direct deposit, and you're almost done with the checklist.

Using transmittal invoices in Payroll means that the changes that you make to invoices that are created in the Payroll application will also balance with the General Ledger. Sometimes the invoices that you enter through Accounts Payable are not being balanced with the liability account that are coming from Payroll.

Both applications need to be installed in the same directory to use Payroll Transmittals. You may need to move an application, if you need help please contact customer service.

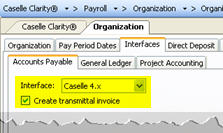

Open Connect Payroll > Organization > Organization. The Accounts Payable properties are stored on the Interfaces tab > Accounts Payable subtab. Select Caselle 4.x as the Interface. Then, click to select the Create Transmittal Invoice checkbox.

When Payroll calculates the transmittal it will use the pay codes on the Interfaces tab > General Ledger subtab to compute amounts for the employee and employer.

Open Connect Payroll > Organization > Organization and navigate to the Interfaces tab > General Ledger subtab. Use the Transmittal Cash Account field to enter the GL account for transmittal cash.

Use Setup a New Transmittal to add new transmittal vendors to the database.

Do this...

1. Open Connect Payroll > Transmittals > Setup New Transmittals.

2. Fill in the options on the form.

Each field on this form is listed in alphabetical order in this help topic.

3. Click Save (CTRL+S).

The transmittal is set up.

Use Modify Existing Transmittals to edit a transmittal that has already been saved in the database.

Do this...

1. Open Connect Payroll > Transmittals > Modify Existing Transmittals.

2. Use the Lookup bar to enter the transmittal number. Press Enter.

3. Now, update the transmittal properties.

4. Click Save (CTRL+S).

The transmittal properties are updated.

Use Modify Existing Transmittals to delete a transmittal that has already been saved in the database.

Important! A transmittal that has a transaction associated with cannot be deleted.

Do this...

1. Open Connect Payroll > Transmittals > Modify Existing Transmittals.

2. Use the Lookup bar to enter the transmittal number. Press Enter.

3. Click Delete (CTRL+D).

The transmittal is deleted.

A transmittal amount is the amount that will be printed on a transmittal invoice or transmittal check.

How do I do this?

Open Connect Payroll > Transmittals > Calculate Transmittal Amounts.

A transmittal invoice is an invoice that is created in Payroll for Accounts Payable, which permits you to use Accounts Payable to issue the actual check. This option is available if the interface to Accounts Payable is enabled. Your accounts payable clerk would then take responsibility for paying the vendor.

How do I do this?

Open Connect Payroll > Transmittals > Create Transmittal Invoices.

An address is a set of directions for delivery of letters and packages. Use a ten-digit telephone number (801) 555-5555 to enter telephone and fax numbers. Use a typical name@organization.org format to enter the email address.

A Group is a category for collecting transmittals with similar characteristics, features, or functions.

What do you want to do?

I want to add the vendor to a group. Use the Group drop-down list to assign the transmittal to a group.

I do not want to add the vendor to a group. Press the Delete key to remove the selected option from the Group field.

A name is a word or phrase that constitutes the distinctive designation of a person.

What do you want to do?

I want to enter the vendor name. Use the Name field to type in the vendor name.

I want to parse the vendor name into first, middle, and last name. Click the Name menu, located at the end of the Name field. Use the Name Details form to enter the vendor name.

Use the options on the Pay Codes tab to select the pay codes that you will use to calculate transmittals for the employee and employer.

What do you want to do?

I want to add pay codes. Click Select on the Pay Codes tab. Use the Selection form to move the pay codes that you want to add to the Selected Pay Codes list. Click OK.

I want to remove pay codes. Click Select on the Pay Codes tab. Then, move the pay codes to remove to the Available Pay Codes list. Click OK.

Remittance refers to the vendor where the transmittal check/invoice is remitted.

What is the remittance vendor name or number?

I know the remit-to vendor name or number. Use the Remittance field to type in a vendor name or number.

Help me find the remit-to vendor. Use the Remittance menu, located at the end of the Remittance field, to search for a vendor name and number.

Show more information about the remit-to vendor. Use the Remittance menu to select Additional Information.

Add a new remit-to vendor. Use the Remittance menu to select Add New.

Update the remit-to vendor's information. Use the Remittance menu to select Modify.

A standard description is a word or phrase that describes the character or features of the transmittal. The routines that calculate and create transmittals will use the standard description to fill in the transaction description.

The transmittal number is a unique number that is assigned to the transmittal vendor.

A vendor is an individual, entity, or organization that will fill the transmittal invoice/check.

What is the vendor name or number?

I know the vendor name or number. Use the Vendor field to type in a vendor name or number.

Help me find the vendor. Use the Vendor menu, located at the end of the Vendor field, to search for a vendor name and number.

Show more information about the vendor. Use the Vendor menu to select Additional Information.

Add a new vendor. Use the Vendor menu to select Add New.

Update the vendor's information. Use the Vendor menu to select Modify.

Use Connect Payroll > Transmittals > Void Transmittal Checks/Invoices.

If transmittals are new to your payroll procedure, verify the CDPT journal exists in the General Ledger Journal Code table.

First, copy the CDP journal code. Open Connect General Ledger > Organization > Journal Code. Look up the CDP journal code. Next, click to select the journal code and click Copy (Shift+F7).

In uppercase letters, type CDPT.

Click OK. Next, change the Title to Cash Disbursements - Payroll Transmittals.

Click Save (CTRL+S). Then, click Close to exit Organization > Journal Codes.

Second, open Connect Payroll > Organization > Update General Ledger. Select the payroll that you wish to update and click GO.

Important! DO NOT select the Update Transactions That Have Already Been Updated checkbox; this will create double-postings.

First, use Connect Payroll > Transmittals > Void Transmittal Checks/Invoices. Select the check to void and reissue, then click Void and Reissue. Next, run Connect Payroll > Transmittals > Transmittal Checks. Select the checks to reissue on the Reprint tab. Click Print (CTRL+P).

First you need to delete the three payroll journals, four if you print transmittal checks from payroll, and then re-post.

Do this...

1. Open Connect General Ledger > Journals > Enter Journal Amounts.

2. When the Options displays, select the PC journal and the Period when the Payroll transactions were updated. Click OK.

3. Click Delete.

4. When the Delete form displays, click Delete Transaction Date Range. If the payroll that was posted twice was your last payroll, you will see the pay period end date in both the Beginning Date and Ending Date field. Click OK.

5. Click Options. Select the PB journal. Click OK.

6. Click Delete. Repeat step 5.

7. Click Options. Select CDP journal. Click OK.

8. Click Delete. Repeat step 5. Verify the check issue date is displayed in the Beginning Date field and Ending Date field.

9. If you print and post transmittal checks from Payroll, complete this section.

A. Click Options. Select CDPT. Click OK.

B. Click Delete. Repeat step 5.

10. Click Close and return to the Caselle Connect Main Menu.

11. Open Payroll > Organization > Update General Ledger.

A. Select the pay period to be updated.

B. Select the Update Transactions That Have Already Been Updated checkbox.

C. Click GO.

Print the Pay Code Transaction Report.

Enter a termination date that occurs before the pay period date and check issue date in the employee's file will exclude the employee from the transmittal report.

Do this...

1. Open Connect Payroll > Employees > Modify Existing Employees.

2. Enter the employee's name or number in the Lookup bar. Press Enter.

3. Go to the Pay Codes tab.

4. Double-click a pay code to select it, or select a line and click Modify the Selected Pay Code.

5. Enter a termination date in the End Date field on the Employee and Employer tabs.

6. Click Close.

You're done.