Review employee benefit transaction hours and amounts by pay code.

A pay code is an account in payroll that records hours worked for an activity. Use the Pay Code Transaction Report to list employe benefit transaction hours and amounts by pay code.

In this Topic Hide

1. Open Connect Payroll > Reports > Pay Code Transaction Report.

2. Select a report title.

3. Enter the Report Dates.

How do I change the date range for quarterly reports?

How do I change the date range for annual reports?

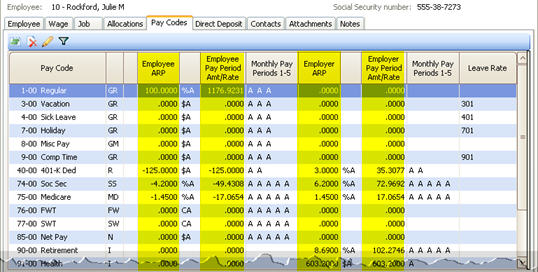

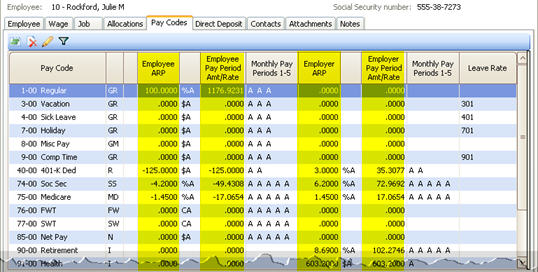

4. Set up the Include Employees Where All Selected Pay Codes are Inactive checkbox.

An active pay code is a pay code that is set up to accrue based on the selected monthly period numbers. An inactive pay code is not set up to accrue based on the selected monthly period numbers. This option will search for employee records that have the selected pay codes and the selected pay codes are inactive.

Do you want to include employees with inactive pay codes?

Yes, I want to include employees with inactive pay codes. Click to select Include Employees Where All Selected Pay Codes are Inactive.

No, I want to leave out employees with inactive pay codes. Click to deselect Include Employees Where All Selected Pay Codes are Inactive.

5. Set up the Include Employees Where All Selected Columns are Zero checkbox.

This option totals the columns in the employee record. If the total for each column is zero, usually the employee record is not active. If the total is not zero, then the employee record is active.

Do you want to include employees when the employee’s pay codes total to zero?

Yes, I want to include employees when the pay code columns totals to zero. Click to select Include Employees Where All Selected Columns are Zero.

No, I want to leave out employees with pay code columns total to zero. Click to deselect Include Employees Where All Selected Columns are Zero.

6. Click the Pay Codes tab.

Use the options on the Pay Codes tab to select the pay codes to include on the report.

7. Click Print (CTRL+P).

The report prints.

Updated 13Dec2017

Use the options on the Pay Codes tab to select the pay codes to include on the report.

Do this...

1. Click Add a New Pay Code Field, its located at the bottom of the Pay Codes tab.

2. Use the options in the Add Pay Code Field to select the pay code name and define the displayed value.

Pay code: Select a pay code name.

Type: Select the type of information to display in the report column.

Include in totals only: Print a total on the report without including the values in the calculation.

3. Click OK.

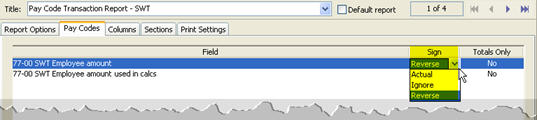

4. Select the Sign.

The sign is the sign that is normally associated with a pay code. Use actual to record the transaction using the sign that is normally assigned to the pay code. Use reverse to record the transaction using the opposite sign from the actual sign. Use ignore to record the transaction with a positive value.

What is the sign assigned to the pay code?

Use the actual value. Select Actual as the Sign.

Use the reverse, or opposite value. Select Reverse as the Sign.

Assign a positive value regardless of the assigned sign. Select Ignore as the Sign.

his option will total the values in a column and print the total on the report.

Do this...

1. Click Add a New Total Field. This link is located at the bottom of the Pay Codes tab.

2. Use the options in the Add Total Field to select the total to print on the report.

3. Click OK.