7b. Update new federal and state tax rates

Payroll Year-end Checklist

IMPORTANT

-

DO NOT load the new tax rate information until AFTER the payroll year is closed.

-

The new Federal and State tax rates are available to download.

What are the new federal and state tax rates?

Payroll uses the federal and state tax tables to calculate the payroll checks for your employees. The IRS and state taxing agency may release new federal and state tax rates for the new payroll year. The last step of the Payroll Year-end Checklist is to load the new federal and state tax tables so Payroll will use the new tax tables to calculate the correct amount on your payroll checks.

When will the new federal and state tax rates be ready?

The new federal and state tax rates are ready to download. An email with the announcement was sent on Tuesday, December 31st.

The IRS is responsible for releasing the federal tax rate schedules for the new tax year. The IRS usually releases a news release towards the end of the year. You can find more information at irs.gov.

The state taxing agency is responsible for releasing the new state tax rates. Caselle waits for the state taxing agency to release the new state tax rates and then we update the tax tables. Some states will release the new tax tables toward the end of the current year or during the beginning the new year. Other states use the fiscal year end instead of the calendar year end to close the payroll year. In some cases, there may not be any changes to the state tax rates.

You'll receive an email from Caselle when the new state tax tables are ready to download.

When can I update the new federal and state tax rates?

You should wait to load the new federal and state withholding tax rates until after you have completed the last pay period of the payroll year being closed and you have completed Steps 1-6 of the Payroll Year End - Checklist. That way the last payroll of the year will use the tax brackets for the payroll year being closed instead of using the tax brackets for the new payroll year.

Watch a video - Step 7a-c. Update tax year, Update FWT and SWT calculation

Loading the new federal and state tax rates

The federal and state withholding tax rates are updated each year by the IRS and state taxing agency. Follow these steps to load the new federal and state withholding tax rates for the new payroll year.

What if my state withholding tax rates are not available? If the state withholding tax rates for your state are not available, you can use the Update Calculations view in Payroll to load the state tax rates later. You should load the new state withholding tax rates before the first payroll of the new year is calculated. You will receive an email from Caselle when your state withholding rates are ready to download.

If the new state withholding rates are not available in time to process the first payroll of the new year, you can use the old state withholding rates until the new rates are available.

Do this...

1. Back up the Payroll database.

Use Send Databases in Connect System Management > System Tools to create a backup file. [More]

2. Open Connect Payroll > Organization > Update Calculations.

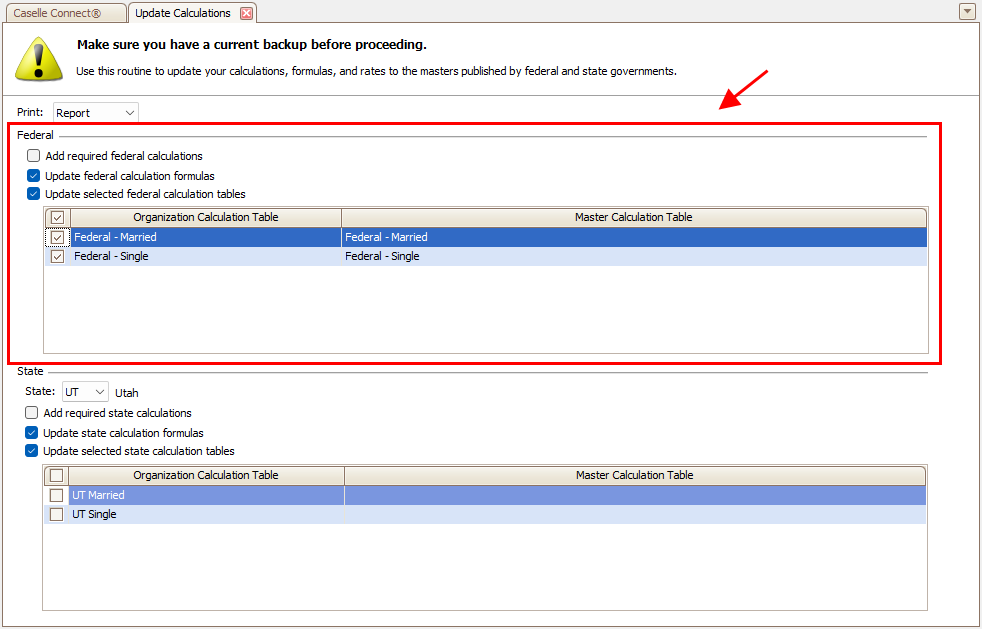

3. Update the federal withholding tax rates.

You will receive an email from Caselle when the federal withholding tax rates are available for the new payroll year.

Set up the following options.

-

Uncheck the Add required federal calculations checkbox.

-

Check the Update federal calculation formulas.

-

Check the Update selected federal calculation tables checkbox.

-

Check the Federal - Married calculation table checkbox.

-

Check the Federal - Single calculation table checkbox.

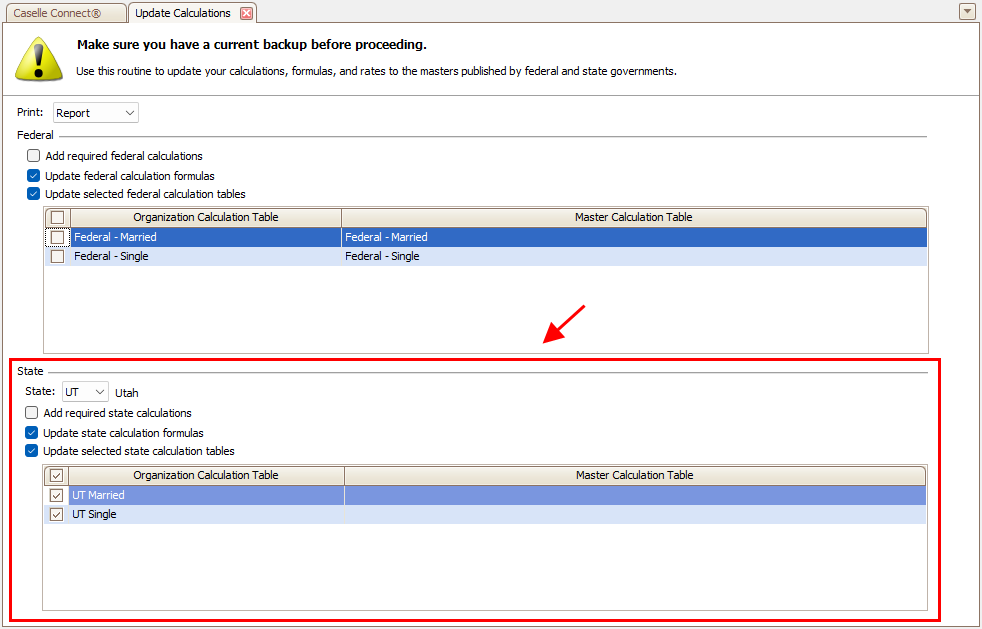

4. Update the state withholding tax rates.

Skip this portion if you are waiting for the email from Caselle to let you know the state withholding tax rates are available to download. You will need to uncheck the two checkboxes to Update state calculation formulas and Update selected state calculation tables in the State section. When it's time to update the state withholding rates, you will need to uncheck the two checkboxes to Update federal calculation formulas and Update selected federal calculation tables in the Federal section.

Set up the following options.

-

Use the State menu to select the 2-character state code.

-

Uncheck the Add required state calculations checkbox.

-

Check the Update state calculation formulas checkbox.

-

Check the Update selected sate calculation tables checkbox.

-

Check all of the [State] - [State tax table description] calculation table checkboxes.

5. Click GO  (CTRL+G).

(CTRL+G).

The federal and state withholding rates for the new payroll year have been installed.

202502, 2025Jan30

Verifying the new calculations, calculation formulas, and calculation values

Use Publication 15 or Publication 15-T to verify the new calculations, calculation formulas, and calculation values. You should verify the new federal information. When the new state information is updated, you should use the state taxing agency website to verify it.

Calculations

-

Open Connect Payroll > Organization > Calculations.

Calculation formulas

-

Open Connect Payroll > Organization > Calculation Formulas.

Calculation tables

-

Open Connect Payroll > Organization > Calculation Tables.

202411, 2024Dec10

Copyright © 2020 Caselle, Incorporated. All rights reserved.