2a. Verify pay code rates and limits

Payroll Year-end Checklist

Start by reviewing the rates and limits for the employee and employer portions on the Social Security and Medicare pay codes that the Payroll application will use to calculate amounts to close the payroll year. And then, review the rates and limits for the employee and employer portions on pay codes that use a rate or limit to calculate an amount.

You’ll need to...

2024 Federal Withholding Tax... Click this link to view the 2024 Federal Withholding Tax [Publication 15-T(2024)] [IRS provides tax inflation adjustments for tax year 2024]

Watch a video

First, check the Social Security Rates/Limits on the Employee and Employer tabs

Look up the Social Security pay code to review the rates and limits are correct for the employee and employer. You can use the pay code list or the pay codes table in the Payroll application.

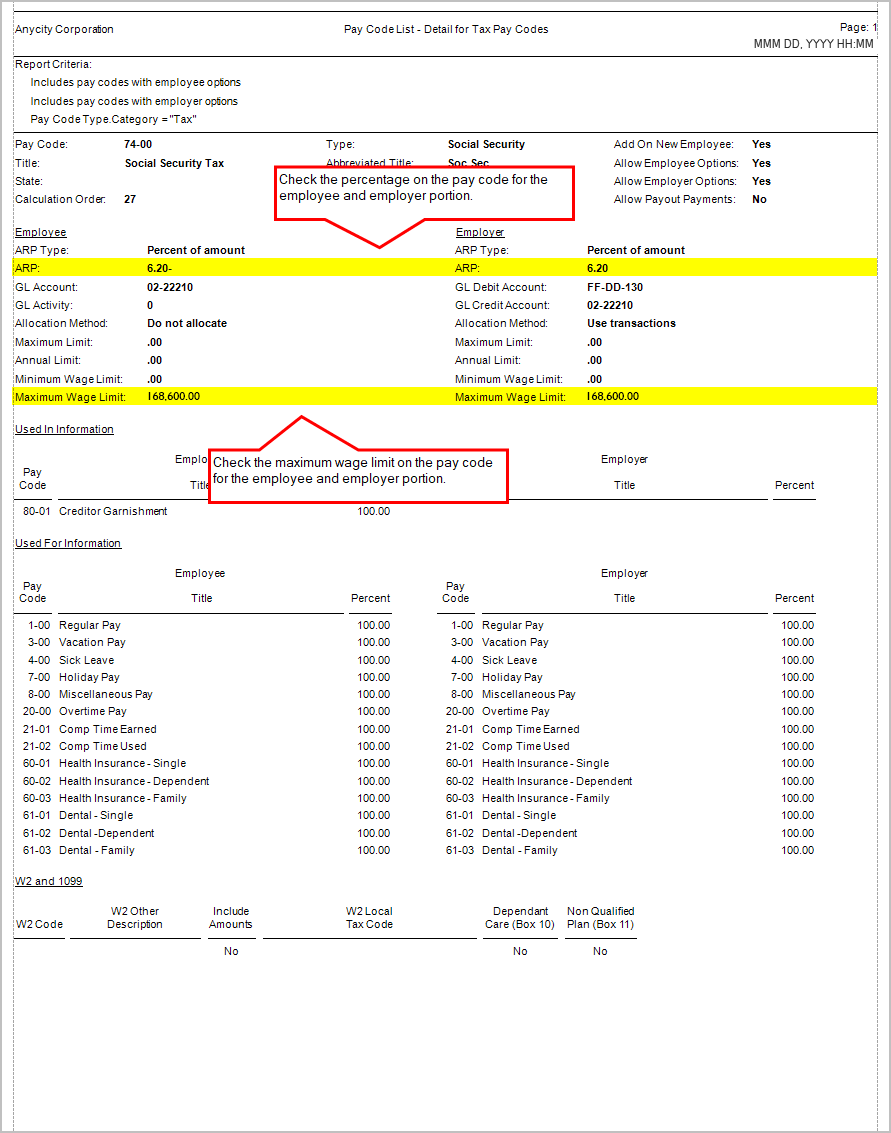

Use the pay code list to verify social security rates/limits

Use the pay codes table to verify social security rates limits

Use the pay code list..

1. Open Connect Payroll > Reports > Pay Code List.

What if I can't click Pay Code List in the Reports menu? You will need user rights to open the Pay Code List. Go to Setup/Modify User Rights to give user rights to the Pay Code List.

2. Use the Definition menu to select Pay Code List - Detail for Tax Pay Codes [Caselle Master].

Pay Code List, Definition menu

3. Click Print  or Print Preview

or Print Preview  .

.

You will be using this report to verify the pay codes for social security, medicare, as well as pay codes that are subject to tax. It may be helpful to print the report or save the report to your computer.

4. Use the report to verify the social security maximum wage limit and percentage.

Pay Code List - Detail for tax pay codes, Social Security Tax pay code

Use the pay codes table...

1. Open Connect Payroll > Organization > Pay Codes.

2. Use the Pay Code box to enter the Social Security Pay Code, and then press Enter.

Example: 74-00 Social Security

Lookup bar

3. Check the rates and limits on the employee portion of the Social Security pay code.

Click the Employee tab > Employee subtab.

Employee tab > Employee subtab

Verify the amount in the Maximum Wage Limit box is correct for the payroll year being closed.

Employee tab > Maximum Wage Limit field

Verify the percentage in the Percentage box is correct for the payroll year being closed.

Employee tab > Percentage field

4. Check the rates and limits on the employer portion of the Social Security pay code.

Click the Employer tab > Employer subtab.

Employer tab > Employer subtab

Verify the amount in the Maximum Wage Limit box is correct for the payroll year being closed.

Employer tab > Maximum Wage Limit field

Verify the number in the Percentage box is correct for the payroll year being closed.

Employer tab > Percentage field

IMPORTANT! Place the tax rate information for the coming year in a safe place. DO NOT load the new tax rate information into the Payroll application until Step 7: Finishing up.

You have verified rates and limits on the employee and employer portion of the Social Security pay code.

202411, 2024Dec10

Second, check the Medicare Rates/Limits on the Employee and Employer tabs

Verify the rates and limits on the employee and employer portion of the Medicare pay code. You can use the pay code list or the pay codes table in the Payroll application.

Use the pay code list to verify medicare rates/limits

Use the pay codes table to verify medicare rates limits

On the report...

1. Use the Pay Code List - Detail for Tax Pay Codes [Caselle Master] to look up the medicare rates and limits for the employee and employer portion.

This is the same report that you printed to check the social security rates and limits.

2. Use the report to verify the medicare maximum wage limit and percentage.

Pay Code List - Detail for tax pay codes, Medicare Tax pay code

In the application...

1. Open Connect Payroll > Organization > Pay Codes.

2. Use the Pay Code box to enter the Medicare pay code for your site, and then press Enter.

Lookup bar

3. Verify the rates and limits on the employee portion of the Medicare pay code.

Click the Employee tab > Employee subtab.

Employee subtab

Verify the amount in the Maximum Wage Limit box is correct for the payroll year being closed.

Employee maximum wage limit on Medicare pay code

Verify the value in the Percentage box is correct for the payroll year being closed.

Employee percentage on Medicare pay code

4. Verify the rates and limits on the employer portion of the Medicare pay code.

Click the Employer tab > Employer subtab.

Employer subtab

Verify the amount in the Maximum Wage Limit box is correct for the payroll year being closed.

Employer maximum wage limit on Medicare pay code

Verify the value in the Percentage box is correct for the payroll year being closed.

Employer percentage on Medicare pay code

You have verified rates and limits on the employee and employer portion of the Medicare pay code.

202411, 2024Dec10

Third, check any other limits that may apply

Review the rates and limits on the employee and employer portion for the following pay codes. You can use the pay code list or the pay codes table in the Payroll application.

-

Disability

-

Deferred Compensation

-

Any pay code that calculates using a rate and limit

Use the pay code list to verify social security rates/limits

Use the pay codes table to verify social security rates limits

On the report...

1. Use the Pay Code List - Detail for Tax Pay Codes [Caselle Master] to look up the pay code rates and limits for the employee and employer portion.

This is the same report that you printed to check the social security and medicare rates and limits.

2. Use the report to verify the maximum wage limit and percentage on pay codes for disability, deferred compensation, and any pay code that calculates using a rate and limit.

In the application...

1. Open Connect Payroll > Organization > Pay Codes.

2. Use the Pay Code box to enter the pay code for disability, and then press Enter.

3. Verify the rate and limit on the employee portion of the pay code.

Repeat the process that you used to verify the rate and limit for the Social Security and Medicare pay codes. You need to check the maximum wage limit and the amount, rate, or percent that's assigned to the employee portion of the pay code.

4. Verify the rate and limit on the employer portion of the pay code.

Do the same check to verify the maximum wage limit and the amount, rate, or percent that's assigned to the employer portion of the pay code.

When you're done verifying the rates and limits on the disability pay code, repeat these steps to verify the rates and limits on the deferred compensation pay code and the other pay codes that use a rate and limit to calculate an amount.

202411, 2024Dec10

Copyright © 2020 Caselle, Incorporated. All rights reserved.