Step 5. Add IRS tax levy pay code to employee

IRS Tax Levy

To add an IRS tax levy to an employee, add the IRS tax levy pay code to the employee record and then, set up the tax levy settings for the employee. You're going to add the IRS tax levy pay code and customize it for the employee using the employee's declaration on parts 2, 3, 4, and 5 to link it to the correct IRS tax levy calculation.

These instructions are for 2023. You may need to update the instructions if you are setting up the IRS tax levy for a different year.

Adding IRS tax levy pay code to employee

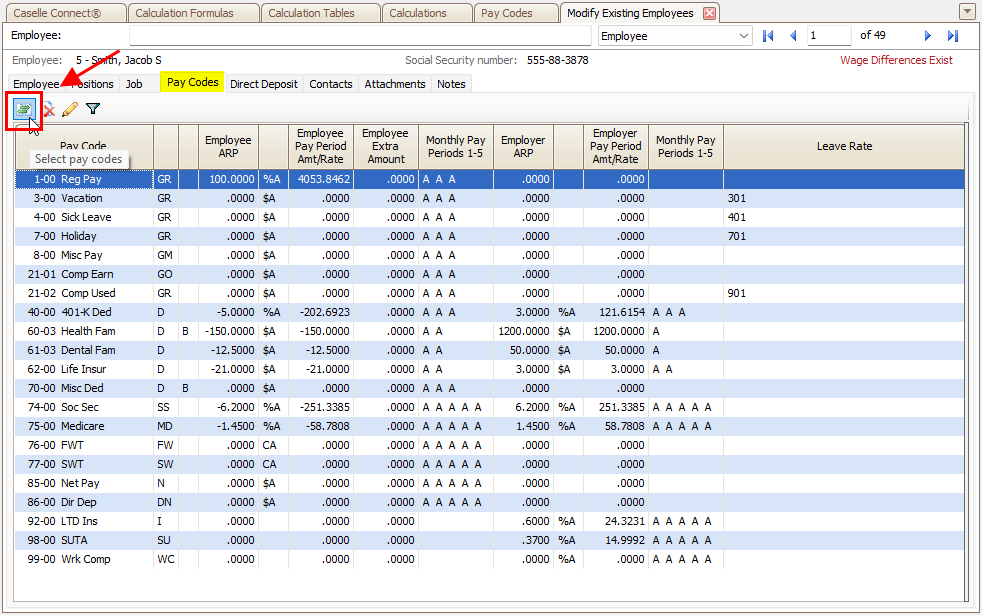

1. Open Connect Payroll > Employees > Modify Existing Employees.

2. Click to select the Pay Codes tab.

3. Click Select Pay Codes  .

.

Pay Codes tab

Move the IRS Tax Levy pay code to the Selected Pay Codes list, and then click OK.

Selection window

4. Click to select the IRS Tax Levy pay code from the list, and then click Toggle Pay Code Detail Display  .

.

Pay Codes tab

5. Set the calculation to use the calculation that matches the employee's IRS tax filing status.

Employee pay code, Calculation

6. Enter the Exemptions and Additional Exemptions as per the employee's declaration on parts 2, 3, 4, and 5 of the IRS levy forms.

7. Click Save (CTRL+S).

You have set up the IRS tax levy for the employee.

202311, 2023Aug02

2023111, 2023

Copyright © 2020 Caselle, Incorporated. All rights reserved.