Step 2. Set up calculation formulas for IRS tax levy

IRS Tax Levy

Add the IRS tax levy calculation formula.

These instructions are for 2023. You may need to update the instructions if you are setting up the IRS tax levy for a different year.

Setting up IRS tax levy calculation formula

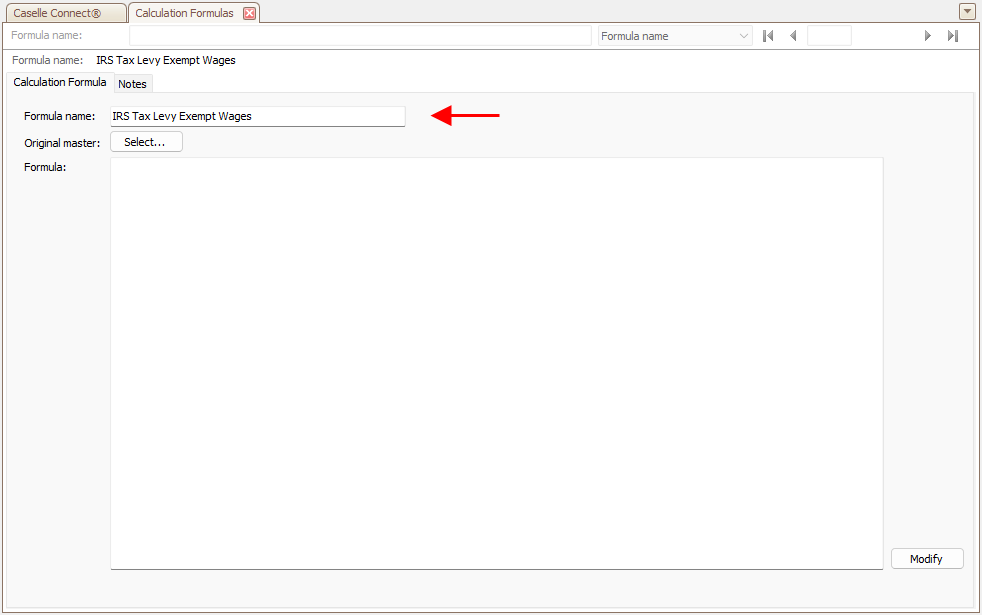

1. Open Connect Payroll > Organization > Calculation Formulas.

2. Click New  (CTRL+N).

(CTRL+N).

3. In the Formula Name box, enter IRS Tax Levy Exempt Wages

Calculation Formula, Formula name

4. Click  .

.

5. Enter the following formula.

Var1 = WagesCurrPer-Modifier1

Var2 = (CurrentExemptions*Modifier2)-(CurrentAdditionalExemptions*Modifier3)

Result = MAX((Var1-Var2),0)

Formula window, Calculation box

Tax Levy Calculation Formula Explanation

-

Var1. Available wages. Subtracts exempt wages from subject wages using the used for calculation setting on the tax levy pay code. This is the wage available to the tax levy.

-

Var2. Allowed exemptions. Uses the addditional exemptions allowed based on the employee's claims on parts 2, 3, 4, and 5 of the wage levy.

-

Result. This is the amount available to the tax levy. It is the available wages less allowed exemptions, but it cannot be less than zero.

5. Click  .

.

Connect will search for errors and typos in the calculation formula. The instructions for correcting the error will be displayed in a dialog box. You want the dialog box that says No Errors Found.

6. Click  .

.

The calculation formula should look like this when you're finished...

Calculation Formula - IRS Tax Levy

7. Click Save  (CTRL+S).

(CTRL+S).

8. Click  (CTRL+F12).

(CTRL+F12).

202308, 2023Aug01

Copyright © 2020 Caselle, Incorporated. All rights reserved.