How do I record a manual check?

Enter a payroll check by hand.

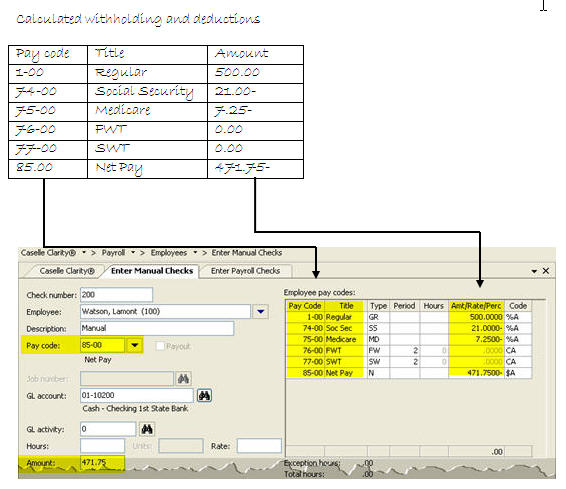

Use Enter Manual Checks to record the manual check, including the withholding and deductions.

Before you get started

Calculate withholding and deductions. See the help topic titled How do I calculate withholding and deductions on a manual check?

Follow your organization's procedures to produce a manual check.

Recording a manual check entry

1. Open Connect Payroll > Employees > Enter Manual Checks. .

The Enter Manual Checks Options form displays.

2. Fill in the fields on the Enter Manual Checks Options.

3. Click OK.

The Enter Manual Checks form displays.

4. Fill in the Check Number, Employee, and Description. .

5. Next, use the pay codes from the Employee Pay Codes grid to enter the first pay code in the list followed by the amount. Use the calculated amounts from Step 1: Calculate Withholding and Deductions. Then, enter the next pay code and amount until the list is finished.

Note: Deductions will be subtracted automatically. If you key a minus (–) sign after you enter a deduction, Connect will add the deduction to the employee’s net pay.

6. Verify the hash total is zero.

If the hash total is not zero, re-check the pay codes and amounts. Verify the pay codes and amounts have been entered correctly. Verify none of the pay codes is missing.

7. Press Enter again to save the transaction.

The manual check entry is finished. You're done.

Options

Amount

Use Amount to enter the check amount.

Check issue date

The check issue date is the date the check was issued. The routine will use this date to record the manual check.

Check number

A check number is a unique number that is assigned to each check.

Create third party check

Use Create Third Party Check to create a manual check entry for a third party. A third party is an individual or organization that is separate from the employee.

Current pay period

The current period is the period the system will use to record transactions.

Deactivate direct deposit

Use Deactivate Direct Deposit to create printed checks for all employees, including employees set up for Direct Deposit.

Description

A description is a word or phrase that describes the character or features of the record.

Employee

An employee is any individual that performs services for an employer. Use the Employee field to enter the employee name or number. Click the Employee menu to view additional options.

GL account

A GL account is an account in the General Ledger that records the manual check entry.

GL activity

A GL Activity refers to a user-defined code that is created in Connect General Ledger for reporting resources and transactions. The GL activity code can report on subsystems that are interfaced to the Connect General Ledger. This interface provides an efficient means of tracking and reporting on a GL activity code.

Hours/units

The hours refers to a unit of time. Use the Hours field to enter a quantity to add it to the leave hours total. If you want to subtract leave hours from the employee's leave hours total, enter a quantity followed by a minus sign (-).

If the pay code does not calculate using hours, then use the Units field to enter a quantity.

Job number

A job number refers to a user-defined code that is created in Connect Project Accounting for reporting resources and transactions associated with a specific job. You can use a job number to manage transactions created in Connect General Ledger and the Connect Project Accounting Suite, which includes Project Accounting, Materials Management, and Asset Management.

Journal

The journal is the place where you will record transactions for manual checks.

Monthly period number

Use the Monthly Period Number to select the period to record the manual check. Each number corresponds to a period.

Override payroll settings

Use Override Payroll Settings to issue the check in a different pay period, use a different tax rate, or create a check entry for an employee who usually receives a paycheck via direct deposit.

Pay code

A pay code is an account in payroll that records hours worked for an activity. Use Pay Code to enter the pay code number that belongs to the benefit that is being adjusted. Use the Pay Code menu, located at the end of the Pay Code field, to view additional options.

What do you want to do?

I want to enter a pay code. Use the Pay Code field to type in a pay code and sub code, if the sub code is not zero.

Help me find a pay code. Use the Pay Code menu to select Search.

I want to add a new pay code. Use the Pay Code menu to select Add New.

I want to modify an existing pay code. Use the Pay Code menu to select Modify.

I want to add a note to the pay code. Use the Pay Code menu to select Comments.

Rate

A rate is a charge, payment, or price fixed according to a ratio, scale, or standard.

Tax rate

If the employer is using a percentage method to calculate the Federal Income Tax Withholding, you can use the Federal Withholding Rate to override the Federal Withholding Rate that will be deducted when you record the manual check.

Like the Federal Withholding Rate, you can also override the State Withholding Rate.

Copyright © 2020 Caselle, Incorporated. All rights reserved.