How do I add a master bank record?

Banks

Set up a master bank record for each bank that you will use in a Connect application. The master bank record will store the bank number and name; bank account; cash account; void check account; and routing number. When you add a bank to a Connect application and the a master bank record exists, you will only need to select the bank number and name instead of setting up another bank record at the application level.

The master bank record will save you time when you need to add a bank to an application. It will also help you when you need to update information for the bank because you only need to update the master bank record in System Management to update the bank record at the application level.

Adding a bank

1. Open Connect System Management > Master Records > Setup/Modify Banks.

2. Click New (CTRL+N).

3. Fill in the options on the form.

GL bank information account description

GL bank information bank account number

GL bank information cash account

GL bank information void check account

ACH bank information routing number

4. Click Save (CTRL+S).

The new master record is created.

Options

Bank number

Enter a bank number that has not been assigned to another bank. This number identifies the bank in Connect.

Name

Enter a bank name.

Abbreviated name

Enter a shorter bank name to use when space is limited on reports and views.

GL bank information account description

Enter a description for the bank's account.

GL bank information bank account number

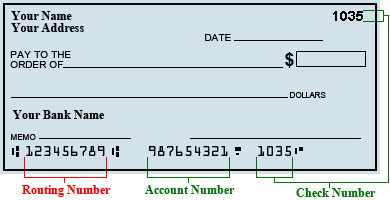

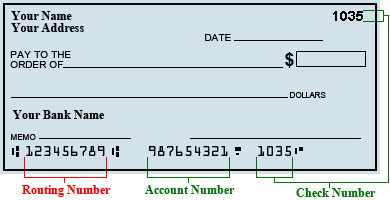

Enter a bank account number. You can find the bank account number printed on the bottom of your checks or printed on your monthly statement.

GL bank information cash account

Enter a cash GL account.

GL bank information void check account

Enter a void check GL account.

ACH bank information routing number

Enter a routing number. The routing number is not the same number as the account number. The routing number is a nine-digit identification number assigned to a bank by the American Bankers Association (ABA). This number identifies the financial institution upon which a payment is drawn or deposited. Routing numbers are sometimes referred to as check routing numbers, ABA numbers, or routing transit numbers (RTN). Routing numbers may differ depending on the state in which your account was open and the type of transactions being made.

2020Jan22

Copyright © 2025 Caselle, Incorporated. All rights reserved.